GR Trading

GR Strategies

&

GR TrendFollowing

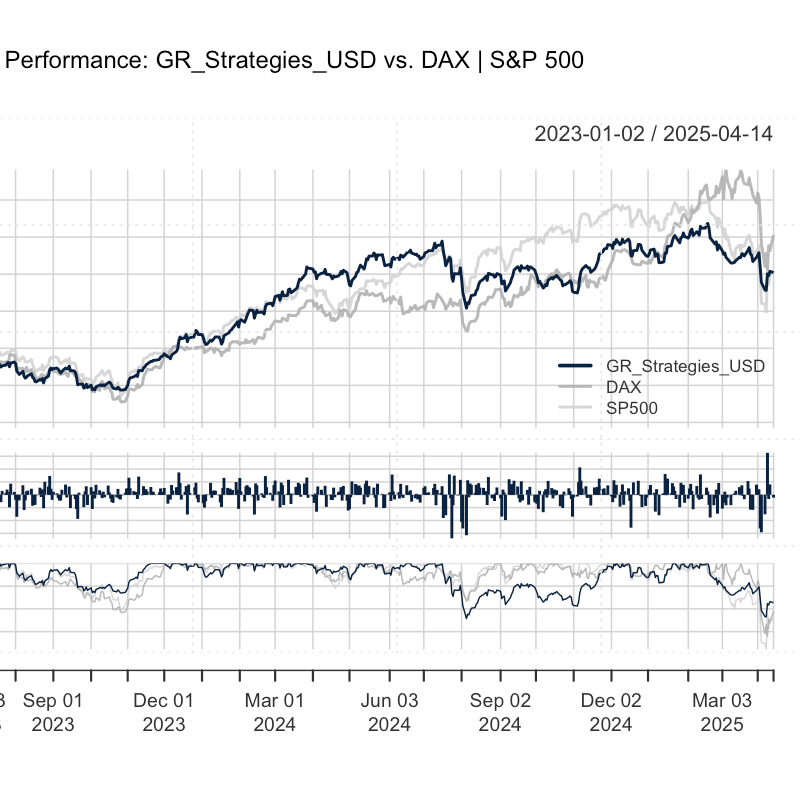

Real - time results since January 2023

The latest developments of my work

Stay up to date with the latest developments in my work — providing a clear and concise overview of all trading strategies within my portfolios.

These portfolios reflect different approaches to navigating global markets:

GR Strategies

A diversified, multi-factor framework with uncorrelated strategies.

GR TrendFollowing

Captures directional price movements through a systematic trend-following model.

The comparison below highlights their core differences — and how they can complement each other within a broader investment portfolio.

I’ve developed applications to follow both strategies real time in live portfolio management!

A Custom Application

Built to Track and Compare

Two Portfolios

GR

Strategies

GR_Strategies_USD AppGR_Strategies_EUR App

GR_Strategies_USD AppGR_Strategies_EUR App Diversified, adaptive investment approach.

Tailored for dynamic global markets.

GR_Strategies, my dynamic and resilient approach, leverages a diverse set of uncorrelated strategies, including GR_TrendFollowing, volatility strategies, momentum accumulation, and others. This ensures robust and adaptable performance, well-suited to the ever-changing dynamics of the global landscape.

GR

TrendFollowing

Focused strategy emphasizing long-term trend capture.

Built for resilience in volatile environments.

GR_TrendFollowing reflects my strong commitment to the trend-following strategy. By integrating this approach into GR_Strategies, which accounts for over 30% of the portfolio, I aim to capture global market trends more effectively. This strategy also introduces a distinctive long-volatility component by dynamically taking long or short positions based on market movements.

Further differences of the portfolios

| GR Strategies | GR TrendFollowing | |

|---|---|---|

| TRADING STYLE: | Diversified multi-strategy | Pure trend-following (CTA) |

| CORE ALLOCATION: | 30% TrendFollowing | 100% |

| VOLATILITY STRATEGIES: | ✅ yes | ❌ no |

| MOMENTUM ACCUMULATION: | ✅ yes | ❌ no |

| DYNAMIC ROTATION: | ✅ yes | ❌ no |

| RISK APPETITE: | Portfolio core, smoother risk-adjusted returns | Tactical allocation, crisis alpha |

| APPLICATIONS: | ✅ GR_Strategies_USD App | ✅ GR_TrendFollowing App |

Everything You Need to Know

Balanced portfolio framework

Together, these strategies create a robust and well - balanced portfolio framework.

By blending simplicity with sophistication, the approach ensures adaptability, consistency, and long - term success, even in the face of unpredictable market conditions.