GR Strategies

Diversified. Resilient. Adaptive.

Combines uncorrelated strategies: Trend Following, Volatility, Momentum & more

Built for stability and long-term success — even in volatile markets

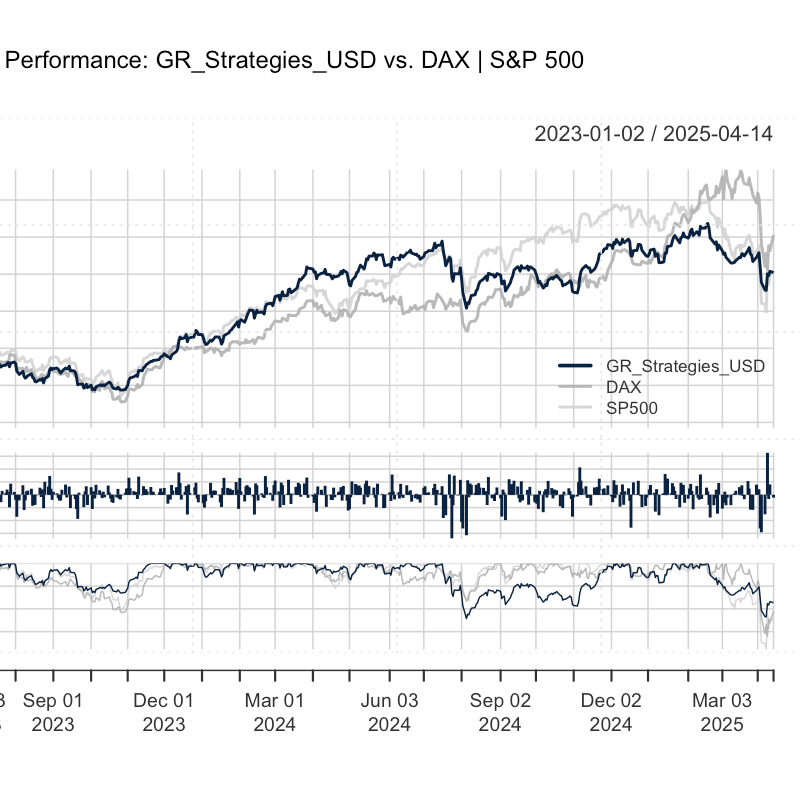

Real - time results since January 2023

Complete Analysis & Information Hub —

In a Single App

Performance analysis from all angles

Performance vs Other Asset Classes

Risk Metrics daily and monthly

Draw Down Analysis

GR_Strategies App:

Not witchcraft, but simple craftsmanship

The beauty of all these strategies lies in their simplicity. Data is downloaded in the morning, calculations take about 15 minutes to ensure theory aligns with practice, and new orders are automatically sent to the exchange shortly before the market closes in the evening.

This is not witchcraft, but simple craftsmanship, ensuring that execution timing has no influence — a crucial element for robustness.

GR_Strategies App:

Trading Statistic

Trading stats offer valuable insight — but they’re just numbers.

Each market day brings a new game with its own rules.

Contact me for full data or run your own analysis anytime.

Why GR_Strategies?

Diversified

The problem surfaces during market downturns, revealing a lack of true diversification and correlation patterns which you did not expect in good time

GR TrendFollowing

GR_TrendFollowing (= CTA)emerges as a truly effective diversification strategy within my portfolio, particularly when navigating through periods of turbulence and uncertainty.

Backtest

I acknowledge that the performance up to December 2022 is a blend of real-time trading and new systems. I found it unfulfilling to rest on the laurels of the past and add it all up again.

Emotional control

I am not guided by greed or panic in my dealings, but rather adhere to the principles of true expertise. Every decision is the result of a deliberate, thoughtful and pure technical approach that avoids impulsive reactions.

GR_Strategies:

My portfolio of different strategies

TrendFollowing strategy

GR_TrendFollowing forms the backbone of diversification with a 30 % allocation. This strategy excels in capturing trends and providing stability during market volatility.

Momentum accumulation strategies

Focusing on harnessing and leveraging market trends for consistent and sustainable growth.

Volatility strategies

Tailored to capitalize on both sudden and sustained market fluctuations, enhancing risk - adjusted returns.

Asset rotation strategies

Dynamically reallocating capital across asset classes to optimize returns and mitigate risks.